Note, that if you leave the initial and final balances unchanged, a higher the compounding frequency will require a lower interest rate. This is because a higher compounding frequency implies more substantial growth on your balance, which means you need a lower rate to reach the same amount of total interest. Use the compound interest rate calculator to compute the precise interest rate that is applied to an initial balance that reaches a certain surplus with a given compound frequency over a certain period. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

You’re our first priority.Every time.

Investment returns are typically shown at an annual rate of return. A compound interest calculator is a useful tool for projecting the potential growth of your mutual fund investments, but it’s crucial to use it properly to avoid misleading projections. By being conservative with your return estimates, accounting for inflation, taxes, and fees, and focusing on the long term, you can create a more realistic picture of how your investments can grow over time. A daily compound interest calculator calculates what you’ll earn (or be charged) every day. With monthly, you’ll earn (or be charged) interest each month, and with annual, you’ll earn (or be charged) every wave accounting 2021 year (an annual percentage).

In reality, investment returns will vary year to year and even day to day. In the short term, riskier investments such as stocks or stock mutual funds may lose value. But amortization — accountingtools over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually.

We can’t, however, advise you about where toinvest your money to achieve the best returns for you. Instead, we advise you to speak to a qualified financial advisor for advice based upon your owncircumstances. $10,000 invested at a fixed 5% yearly interest rate, compounded yearly, will grow to $26,532.98 after 20 years. This means total interest of $16,532.98 anda return on investment of 165%. However, visualising this potential impact of compounding can be tricky.

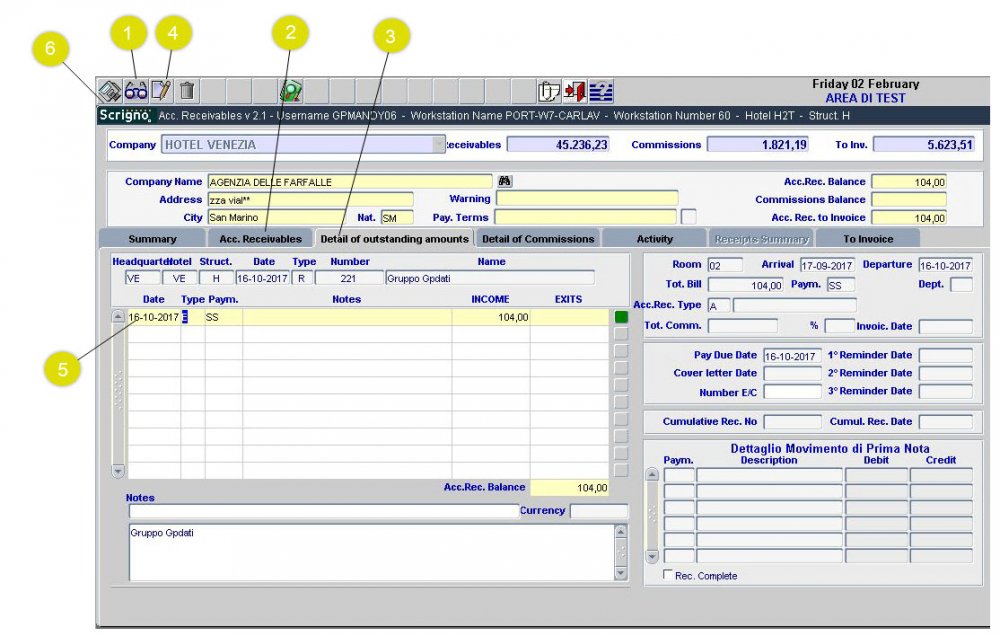

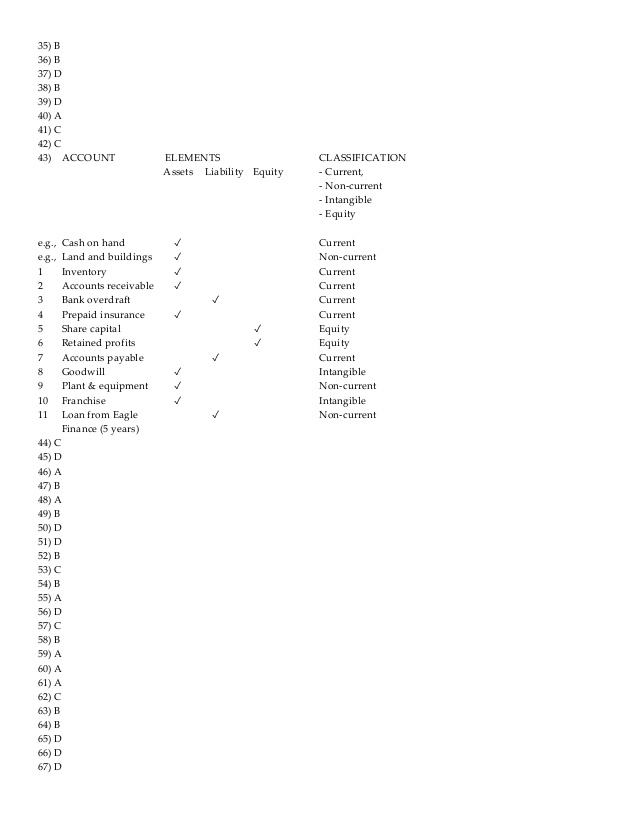

Investment details

Sign up to get updates from MoneyGeek including how to overcome your financial headwinds, hack your finances, and build wealth. You may choose to set the frequency as continuous, which is a theoretical limit of recurrence of interest capitalization. In this case, interest compounds every moment, so the accumulated interest reaches its maximum value. To understand the math behind this, check out our natural logarithm calculator, in particular the The natural logarithm and the common logarithm section. As a free resources for nonprofits final note, many of the features in my compound interest calculator have come as a result of user feedback.

So, if you have any comments or suggestions, I would love to hear from you. Let’s cover some frequently asked questions about our compound interest calculator. Another strategy to counter this would be to consider multiple scenarios (optimistic, pessimistic, and average) to get a more realistic range of possible outcomes. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. It is for this reason that financial experts commonly suggest the risk management strategy of diversification.

- While mutual funds, particularly equity funds, can provide inflation-beating return potential in the long term, these can fluctuate significantly depending on market conditions, fund type, and economic cycles.

- We’ve discussed what compound interest is and how it is calculated.

- To understand the math behind this, check out our natural logarithm calculator, in particular the The natural logarithm and the common logarithm section.

Use the Bar Chart to Explore Growth Over Time

The initial bar chart showcases how compound interest grows over time on top of your principal amount. Using the definition above, the compound interest rate is the annual rate where the compounding frequency is taken into account. You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings. Note that you can include regular weekly, monthly, quarterly or yearly deposits in your calculations with our interest compounding calculator at the top of the page. While a compound interest calculator is simple to use, there are some factors to keep in mind to avoid making unrealistic expectations or misinformed decisions. In this article, we will explore five possible mistakes to be mindful of when using a compound interest calculator to help you make optimum use of this tool.

What is the effective annual interest rate?

Simply the past year’s returns are not enough as the fund could have had an exceptionally good or bad year. Compound interest, on the other hand, puts that $10 in interest to work to continue to earn more money. During the second year, instead of earning interest on just the principal of $100, you’d earn interest on $110, meaning that your balance after two years is $121.