Even before the 1970s, some economists criticized the notion of a stable relationship between inflation and unemployment. They argue that consumers and producers adjust their economic behavior to rising price levels either in reaction to—or in expectation of—monetary policy changes. “During a period of stagflation, businesses struggle to grow due to slowing economic activity, and cannot easily reduce costs due to rising input prices,” Brochin says. Political economists Jonathan Nitzan and Shimshon Bichler have proposed an explanation of stagflation as part of a theory they call differential accumulation, which says firms seek to beat the average profit and capitalisation rather than maximise. According to this theory, periods of mergers and acquisitions oscillate with periods of stagflation.

Random Glossary term

“That this index is widely referred to as the ‘misery index’ shows how painful stagflation is,” Brochinm says. To combat inflation, the Federal Open Market Committee (FOMC) can raise interest rates, but doing so also causes households to cut back on spending because savings rates rise. This reduced spending erodes businesses’ bottom lines and can reduce hiring, thus unemployment rises. The 1970s are known for many things, but the one economists are most likely to recall is stagflation, the combination of high inflation and unemployment that can cripple an economy and investor portfolios. Rental properties would have made sense in the 1970s, but in the post-pandemic inflationary period, rental property investing was a tricky business.

Cost-push inflation reflects a rise in prices of one or more key economic inputs, such as crude oil, grain, or labor. Cost-push inflation results when producers are able to recoup their increased costs by increasing the price of finished products. If input costs rise as a result of a temporary disruption in supply such as factory closings caused by a pandemic, for example, policymakers may reasonably assume the price pressures will prove temporary as well. If you want more tactical advice, consider overweighting defensive stocks in sectors such as consumer staples, utilities, energy and healthcare, Brochin says. Businesses in these sectors tend to have more stable earnings, which can provide some protection against stagnant economic growth and inflation. “In particular, we believe investors should favor companies with pricing power that are able to pass increased costs to consumers.”

How Is Stagflation Measured?

After Iain Macleod, a British Conservative Party politician, used the term stagflation during a speech to Parliament in 1965. It was adopted by the media, who began using it when referring to the economic conditions that impacted the country from 1973 to 1982. Since then, economists have studied what factors lead to stagflation and developed methods for measuring it. Their findings also include practical suggestions for how investors can protect their finances during periods of stagflation. During a recession, policymakers can turn to expansionary monetary and fiscal policies to stimulate the economy, but these same policies exacerbate the inflationary side of stagflation. And since inflation is generally experienced by a wider share of the public than job loss, as Steven Wieting, chief investment strategist at Citi Global Wealth Investments, points out, this can lead to a great deal of hurt.

Austrian School of economics

Inputs include labor and capital, while the output is typically measured in revenue and other GDP components, including business inventories. “Stagflation is often caused by adverse supply-side shocks, for example a sudden increase in the price of essential commodities” Brochin says. This was the case in the 1970s when world food shortages met increased energy costs.

Stagflation refers to an economy characterized by high inflation, low economic growth and high unemployment. Another theory is that the confluence of stagnation and inflation is the result of poorly made economic policy. Harsh regulation of markets, goods, and labor in an otherwise inflationary environment are cited as the possible cause of stagflation. Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another. “Stocks have historically delivered high enough returns to beat inflation, but they often need economic growth to do that,” Martin says.

In Germany the total expenditure of the Empire, the Federal States, and the Communes in 1919–20 is estimated at 25 milliards of marks, of which not above 10 milliards are covered by previously existing taxation. In Russia, Poland, Hungary, or Austria such a thing as a budget cannot be seriously considered to exist at all. Thus the menace of inflationism described above is not merely a product of the war, of which peace begins the cure.

Monetarist economists cite too rapid growth in the money supply for creating a situation where too many dollars are chasing too few goods. Supply-side economists blame high taxes, excessive regulation of businesses, and a persistent welfare state that enables people to survive without working. Additional theories exist that stagflation is simply a natural part of the business cycle in modern economies or that politics or social structures are to blame for stagflation. Those supply shocks followed a period of accommodative monetary policy in which the Federal Reserve grew the money supply to encourage economic growth. Meanwhile, global economic growth slowed sharply in the What is m&a 1970s—a decade marked by two different recessions in the U.S. and the lead-up to a third one that began in 1980.

Because bouts of stagflation are so rare, very unusual events must occur to create a backdrop whereby the economy is “dead in the water,” and there’s high inflation, notes Brad McMillan, chief investment officer at Commonwealth Financial Network. While appealing, this is an ad-hoc explanation of the stagflation of the 1970s which does not explain later periods that showed a simultaneous rise in prices and unemployment. One theory states that stagflation is caused when a sudden increase in the cost of oil reduces an economy’s productive capacity. The term stagflation was first used by British politician Iain Macleod in a speech before the House of Commons in 1965, a time of economic stress in the United Kingdom. He called the combined effects of inflation and stagnation a “‘stagflation situation.” There are multiple theories about why stagflation occurs put forth by Keynesian, monetarist, and supply-side economists.

- In 2022, we are seeing a rise in global inflation due to supply side shocks, rising oil prices and supply chains adjusting to Covid shocks.

- The various belligerent Governments, unable, or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance.

- In the 1970s, the US experienced a sharp rise in inflation due to the pressure of rising oil prices.

- This caused the global price of oil to rise dramatically, therefore increasing the costs of goods and contributing to a rise in unemployment.

Unfavorable demographic trends caused by an aging population that leaves fewer people in the workforce alongside increased taxes and regulations could cause economic growth to stagnate, Rosen says. The presumption of a spurious value for the currency, by the force of law expressed in the regulation of prices, contains in itself, however, the seeds of final economic decay, and soon dries up the sources of ultimate supply. A system of compelling the exchange of commodities at what is not their real relative value not only relaxes production, but leads finally to the waste and inefficiency of barter. It was popularized in the 1970s as a rough measure of the economic distress amid stagflation.

Whether or not the U.S. will experience another bout of stagflation remains to be seen. Haworth says that investors have been battling two headwinds—high inflation and rising interest rates—that don’t necessarily create a clearcut path for investing. The dramatic episodes of stagflation in the 1970s may be historical footnotes today. But, since then, simultaneous economic stagnation and rising prices appear to be part of the new normal of economic downturns. This index, a simple sum of the inflation rate and the unemployment rate, tracked the real-world effects of stagflation on a nation’s people. Preparing your finances for stagflation is no easy task, but following general financial guidance such as continuing your investment plans, living within your means, and saving can help you weather a period where the economy is both stagnant and inflationary.

In a note to clients last week simply titled “No sign of ‘stagflation,'” Bank of America analysts said the lower-than-expected gross domestic product report for the first quarter was mostly a function of accounting, not 3 ways to invest money as a beginner of softening underlying demand. However, aside from a brief but severe recession due to the pandemic lockdowns in 2020, the economy muddled through, with gross domestic product (GDP) mostly positive and relatively steady. Stagflation doesn’t respond to the conventional monetary tools based on the Phillips curve (see figure 1). According to the classic theory, when inflation is high, unemployment is supposed to be low, and vice versa.

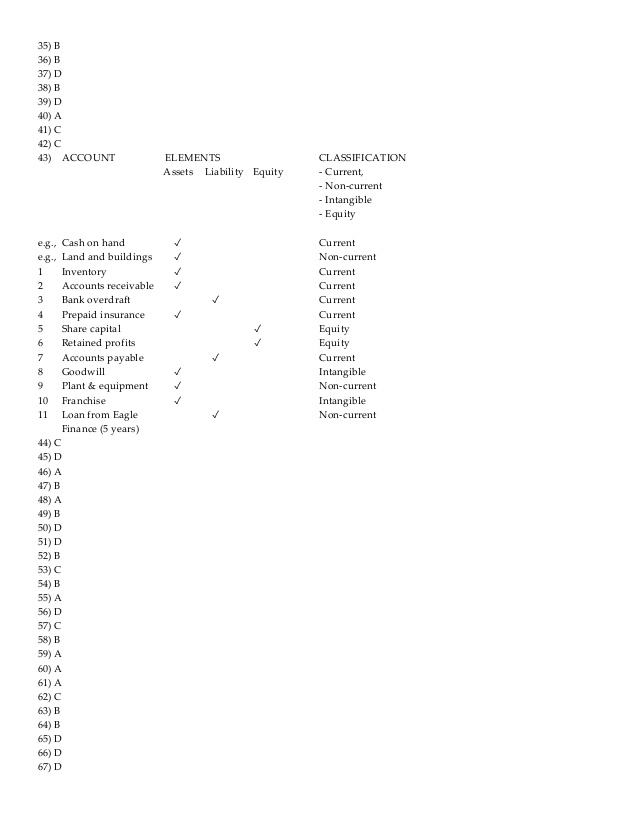

In June 2022, Forbes magazine argued that a period of stagflation was likely because economic policymakers would tackle unemployment first, leaving inflation to be dealt with later. The Federal Reserve raised the federal funds rate over time to an alarming level of 19%. It maintained it, causing two recessions to occur in the years following the Great Inflation before things settled down. By moneyball 1984, over 52,000 businesses had failed, home and car sales dropped dramatically, and unemployment rose to as high as 10%. Price increases aren’t the only rising indicator that suggests the possibility of stagflation.